Hydrogen vs Solar vs Oil & Gas: Which Energy Solution Is Best for Your Industrial Operation?

Choosing the right energy solution for your industrial operation isn't just about cutting costs: it's about future-proofing your business while maintaining reliable operations. With hydrogen gaining momentum, solar becoming more affordable, and oil & gas still dominating the market, industrial leaders face a complex decision that will impact their bottom line for decades.

Let's break down each option with real numbers, practical considerations, and actionable insights to help you make the best choice for your specific situation.

The Current Energy Landscape: Where We Stand in 2025

The industrial energy landscape is shifting faster than ever. Solar and wind have grown to about 13% of global electricity generation, while hydrogen remains under 1% of the energy mix: but that's changing rapidly. Oil and gas still power most industrial operations, but their long-term viability is increasingly questioned.

For industrial companies, this creates both opportunity and uncertainty. The key is understanding which solution aligns with your operational needs, budget constraints, and long-term strategy.

Energy Density and Efficiency: The Power Behind Your Operations

When it comes to pure energy density, hydrogen is the clear winner. It contains approximately three times more energy than oil and natural gas by volume, making it incredibly efficient for high-energy industrial processes. Hydrogen fuel cells are also 2-3 times more efficient than internal combustion engines, potentially reducing your overall energy consumption significantly.

Oil and gas offer immediately available, energy-dense fuels with proven performance in heavy industrial applications. They're particularly effective for high-temperature processes, large-scale manufacturing, and operations requiring consistent, controllable energy output.

Solar and wind, while producing clean electricity, face inherent limitations in energy density. They require significant land area and storage solutions to match the concentrated energy output of fossil fuels or hydrogen. However, for electricity-heavy operations, they can provide cost-effective power once infrastructure is in place.

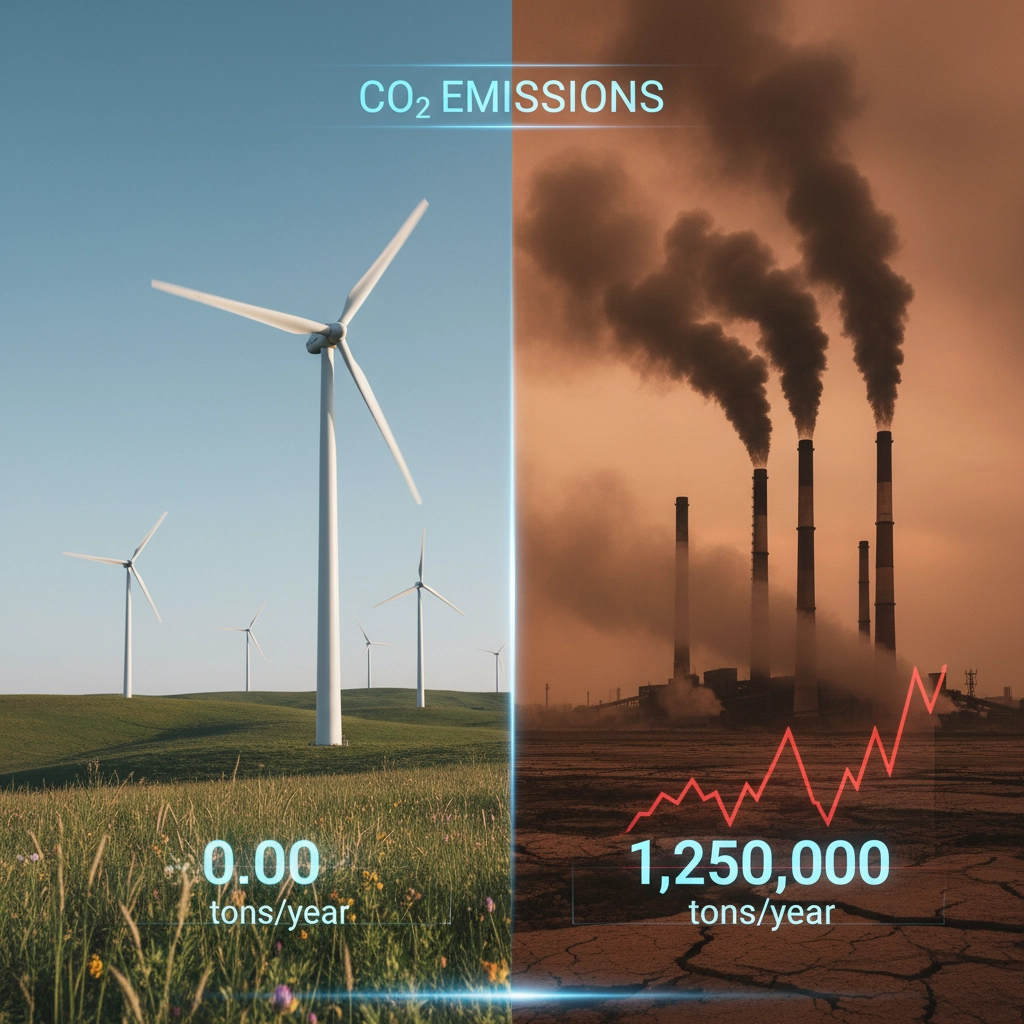

Environmental Impact: The Real Carbon Footprint

The environmental story varies dramatically across these options. Solar and wind have significantly lower lifecycle emissions: wind averages 34g CO₂/kWh and solar around 40-50g CO₂/kWh. Compare that to coal at 800g or natural gas at 400g, and the difference is striking.

However, renewable energy requires substantial mineral extraction. Solar installations demand six times more critical minerals than gas plants per megawatt, including copper, lithium, nickel, and cobalt. This creates supply chain considerations you'll need to factor into your sourcing strategy.

Hydrogen's environmental profile depends entirely on how it's produced. Green hydrogen (from renewable electricity via electrolysis) offers minimal emissions, while blue hydrogen (from natural gas with carbon capture) costs USD 1.50-3.50 per kilogram but only captures 65-90% of CO₂ emissions. Gray hydrogen (conventional production) can emit as much as coal.

Cost-Effectiveness: Understanding the True Economics

Oil and gas remain highly profitable due to established infrastructure and supply chains. However, price volatility creates budget uncertainty: something many industrial operators know all too well.

Solar costs have dropped 90% between 2010 and 2019, making it increasingly attractive for operations with high electricity demand. Wind follows similar cost reduction trends, particularly for large-scale installations.

Hydrogen costs are declining but remain higher than conventional fuels. Blue hydrogen currently costs USD 1.50-3.50 per kilogram, while green hydrogen costs are expected to become competitive as production scales. The key insight: hydrogen will likely be more competitive and less lucrative than oil and gas long-term, meaning better pricing for industrial buyers.

Reliability and Infrastructure: What You Can Count On

For industrial operations, reliability isn't negotiable. Oil and gas provide highly reliable, dispatchable energy without weather dependence. Existing infrastructure means minimal setup costs and proven supply chains.

Solar and wind are intermittent by nature, requiring energy storage solutions and grid integration. While technology improvements are reducing these challenges, they still require careful planning for industrial applications with consistent energy demand.

Hydrogen offers reliability similar to fossil fuels once produced, but production infrastructure is minimal compared to oil and gas. However, hydrogen is particularly valuable for energy storage and can provide backup power for critical operations.

Industrial Application Suitability

Heavy Manufacturing and Steel Production: Hydrogen excels in high-temperature applications and hard-to-abate sectors. It's already used in oil refining and chemicals production, making it a natural fit for similar industrial processes.

Facility Operations and General Power: Solar and wind work well for powering facilities, lighting, HVAC systems, and general electrical needs. They're particularly effective for operations in areas with good solar or wind resources.

Process Heat and Large-Scale Operations: Oil and gas remain superior for high-temperature industrial processes, large-scale manufacturing, and operations requiring immediate, controllable energy output.

Long-Duration Storage: Hydrogen offers unique advantages for storing energy over extended periods, making it valuable for seasonal energy storage and backup power systems.

Making the Decision: A Framework for Industrial Leaders

The best energy solution depends on your specific circumstances. Here's how to approach the decision:

Start with your energy profile: Analyze your current energy consumption patterns, peak demand periods, and critical processes that cannot tolerate interruptions.

Assess your geography: Solar works best in sunny regions, wind in windy areas, and hydrogen where you can access clean production or reliable supply chains.

Consider your timeline: Need immediate solutions? Oil and gas or existing renewable infrastructure might be your best bet. Planning for 5-10 years out? Hydrogen becomes more attractive as costs decline and infrastructure develops.

Evaluate your risk tolerance: Can you handle energy price volatility (oil/gas) or weather-dependent supply (renewables)? Or do you need the predictable costs that come with long-term renewable contracts?

Strategic Recommendations by Industry Sector

Chemical and Refining: Consider hydrogen for process applications, especially if you're already using hydrogen in your operations. The transition from gray to green or blue hydrogen can reduce emissions while maintaining operational efficiency.

Manufacturing and Assembly: A hybrid approach often works best: renewable electricity for facility power combined with reliable baseload from gas or hydrogen for critical processes.

Food Processing: Solar can be excellent for refrigeration and general facility power, while maintaining gas backup for critical temperature-controlled processes.

Mining and Heavy Industry: Hydrogen offers compelling advantages for mobile equipment and remote operations where fuel transport costs are high.

The Hybrid Strategy: Why Not All Three?

Many successful industrial operations are adopting hybrid energy strategies that combine multiple sources. This approach offers several advantages:

- Risk mitigation: Diversifying energy sources reduces dependence on any single fuel type or supplier

- Cost optimization: Using the most cost-effective source for each specific application

- Reliability enhancement: Backup systems ensure continuous operations regardless of supply disruptions

- Future flexibility: Gradual transition capabilities as technology and markets evolve

A typical hybrid strategy might include solar for daytime facility power, hydrogen for process heat and energy storage, and natural gas as a reliable backup during the transition period.

Looking Ahead: The 2025-2030 Transition

The energy landscape will continue evolving rapidly. Hydrogen production is projected to increase by 80% by 2050, with most coming from renewable-powered electrolysis. Solar and wind are expected to reach 30% of electricity generation in developed markets by 2030.

For industrial leaders, this means making decisions that position your operations for both today's realities and tomorrow's opportunities. The companies that thrive will be those that start planning their energy transition now, rather than waiting for perfect solutions.

Whether you choose hydrogen, solar, oil and gas, or a combination of all three, the key is making an informed decision based on your specific operational needs, geographic advantages, and long-term business strategy. The future of industrial energy is increasingly diverse: and that's actually good news for companies willing to think strategically about their energy mix.

Ready to explore energy solutions for your industrial operation? Contact our energy strategy experts to discuss your specific needs and develop a customized energy roadmap.